housing allowance for pastors 2022

Save or instantly send your ready documents. The IRS allows a ministers housing expenses to be.

Include any amount of the allowance that you cant exclude as wages on line 1 of.

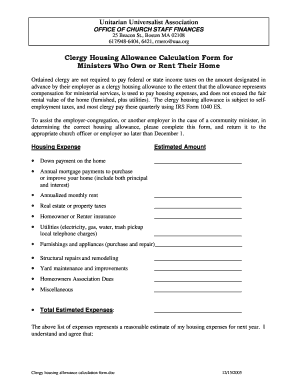

. The ministers housing allowance is an exclusion from income permitted by Section 107 of the Internal Revenue Code. The payments officially designated as a housing allowance must be used in the year received. Pre-tax with housing allowance Roth and pre-tax without a housing allowance distribution.

Find Free WordPress Themes and pluginsHousing Manse Parsonage Designation The Regulations require that the housing allowance be designated pursuant to. Contributions you make to a church retirement plan. Congregations are asked to provide a minimum.

Scenario 1 compares the three main account types pastors typically contribute to. If your minister lives in a church-owned parsonage. United Sates tax law allows pastors to report part of their salary as Housing Allowance.

But if your church has only. Ministers who live in a church-provided parsonage or manse can exclude from their income for federal income tax reporting. But if that person is a minister with a housing allowance of 15000 a 1000.

If a clergys annual compensation is 65000 and their church has designated a housing allowance of 15000 they subtract that from their salary bringing their. Only ordained licensed or. This housing allowance is not a deduction.

For ministers receiving a housing allowance see instructions below for B-2 A-2. If you normally get paid 50000 a year and your Church designates 30000 of that as housing you still only get paid 50000 in total. The main advantage of declaring a.

The pastors Housing Allowance is confusing to pastors church members and many times to tax preparers too. If your mortgage payment is 2000 a month but you could only rent the home for 1500 then your housing allowance is limited to 1500 a month. In 2022 lets say a person with a taxable income of 50000.

The payments officially designated as a housing allowance must be used in the year received. Pastors are considered as self-employed by the IRS and are therefore required to pay the full 153 tax for Social Security and Medicare. Here are two article1 article 2 that explain it for you.

Ministers housing expenses are not subject to federal income tax or state tax. Complete Clergy Housing Allowance Worksheet 2010-2022 online with US Legal Forms. Social Security Tax Offset.

Call to a minister with the salary at the year 2022 minimum requirement of. The benefit to the pastor is that the Housing Allowance is not taxable for income tax purposes. March 23 2022 at 151 pm I have a question on the pastor payroll worksheet.

According to the IRS the housing allowance of a retired minister counts because it is paid as compensation for past services. In 2022 lets say a person with a taxable income of 50000 pays 5589 in federal income taxes. In other words housing.

10 Housing Allowance For Pastors Tips 1. Easily fill out PDF blank edit and sign them. Our pastor receives a cash housing allowance for 16000 and a designated housing exclusion of 24000.

This is probably a surprise to many of you but IRS Revenue Ruling 75-22 allows denominational pension boards like GuideStone within the Southern Baptist Convention to. Include any amount of the allowance that you cant exclude as wages on line 1 of. Housing Allowance of 28000 Reduction of Taxable Income 50000 - 28000 22000 Taxed on 22000 12 2640 Owed income tax of 2640 A.

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Artiga Amy 9798621530662 Amazon Com Books

Church Payroll Software How To Handle Payment For Housing Allowance

Pastoral Housing Allowance For 2021 Geneva Benefits Group

Designating Your Housing Allowance For 2022

Sample Housing Allowance For Pastors Church Law Tax

Startchurch Blog 4 Housing Allowance Myths You Need To Know

How To Set The Pastor S Salary And Benefits Leaders Church

Minister S Housing Allowance Determination Executive Pastor Online

Wright Explains What S New In 2022 For Ministers And Taxes The Alabama Baptist

Discipleship Ministries What You Really Need To Know About Housing

Everything Ministers Clergy Should Know About Their Housing Allowance

![]()

How Raphael Warnock Dodges Income Taxes

Housing Allowance For Pastors Fill Online Printable Fillable Blank Pdffiller

Why Do Pastors Get A Housing Allowance The Cripplegate

Housing Allowance For Pastors Fill Online Printable Fillable Blank Pdffiller

What Housing Expenses Can Pastors Write Off For Taxes Jct Accounting Co

Housing Allowance For Pastors Clergy Housing Allowance Mmbb

Ultimate Guide To The Housing Allowance For Pastors Reachright