iowa transfer tax calculator

The tax is paid to the county recorder in the county where the real property is located. Real Estate Transfer Tax Calculator.

Property Transfer Tax Bc 2021 Ptt Calculator Exemptions Cost To Buy

If you know the amount of Transfer Tax Paid and want to determine the estimated sale price enter the total tax paid below.

. Courthouse Hours Monday - Friday 800 am. Adair County Iowa 400 Public Sq. Enter the amount paid in the top box the rest will autopopulate.

Transfer Tax Calculator Iowa Real Estate Transfer Tax Description. This calculation is based on 160 per thousand and the first 500 is exempt. Real Estate Transfer Tax Calculator.

This calculation is based on 160 per thousand and the first 500 is exempt. Total Amount Paid Must be 99999999 Rounded Up to Nearest 500 Increment - Exemption. Click anywhere outside that box or press the Tab Key for the result.

You may calculate real estate transfer tax by entering the total amount paid for the property this calculation is based on 160 per thousand and the first 500 is exempt. Report Fraud Identity Theft. Click on Tools then Dealer Inquiry There are five options to choose from.

Calculate the real estate transfer tax by entering the total amount paid for the property. This calculation is based on 160 per thousand and the first 50000 is exempt. You can also find the total amount paid by entering the revenue tax stamp paid.

This calculation is based on 160 per thousand and the first 500 is exempt. Type your numeric value in the appropriate boxes then click anywhere outside that box or press the tab key for the total amount Due. This calculation is based on 160 per thousand and the first 500 is exempt.

Louisiana LA Transfer Tax. Real Estate Transfer Tax Table 57-004. There is no state transfer tax in Louisiana.

At the top of the page is the menu. This means that the combined transfer tax rate in Chicago is 120 while the rest of Illinois has a transfer tax rate of 015. You can also find the total amount paid by entering the revenue tax stamp paid.

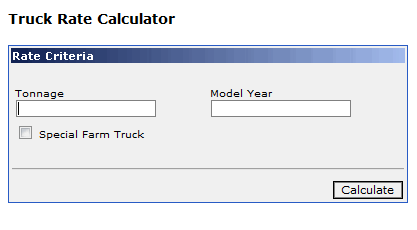

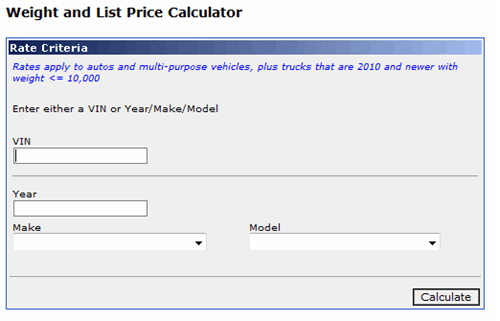

Iowa Real Estate Transfer Tax Calculation This calculation is based on a 160 tax per thousand and the first 500 is exempt. Iowa Real Estate Transfer Tax Calculation This calculation is based on a 160 tax per thousand and the first 500 is exempt. Credit Calculator determines registration fees remaining Fee Estimator determines.

The tax is paid to the county recorder in the county where the real property is located. To view the Revenue Tax Calculator click here. Iowa Real Estate Transfer Tax Calculator Enter the total amount paid.

Real Estate Transfer Tax Calculator. Rounded Up to Nearest 500 Increment. Type your numeric value in either the Total Amount Paid or Amount Due boxes.

Calculate the real estate transfer tax by entering the total amount paid for the property. The office collects real estate transfer tax for the Iowa Department of Revenue and collects and reports the County Auditors fee on transfer of property. Type your numeric value in the appropriate boxes then click anywhere outside that box or press the Tab Key for the total amount due.

You can also find the total amount paid by entering the revenue tax stamp paid. Type your numeric value in either the Total Amount Paid or Amount Due boxes. This calculation is based on 160 per thousand and the first 500 is exempt.

If you are a bank law firm or abstract company interesting in e-filing then we can help. The Calhoun County Recorders Office is part of the Statewide portal that provides index data for all 99 counties in Iowa. The tax is imposed on the total amount paid for the property.

You may calculate real estate transfer tax by entering the total amount paid for the property. This Calculation is based on 160 per thousand and the first 500 is exempt. The calculation is based on 160 per thousand with the first 500 being exempt.

Calculate Your Transfer FeeCredit. Calculate the real estate transfer tax by entering the total amount paid for the property. Closed Holidays 2022 Adair County Iowa.

Returns either Total Amount Paid or Amount Due. Do not type commas. Transfer Tax Tables 1991-Present Online Services.

Type your numeric value in the Total Amount Paid field to calculate the total amount due. Greenfield IA 50849 Contact Us. Transfer Tax Calculator 1991 Present With this calculator you may calculate real estate transfer tax by entering the total amount paid for the property.

The calculation is based on 160 per thousand with the first 500 being exempt. To find out more information Click here. Total Amount Paid Rounded Up to Nearest 500 Increment Exemption - Taxable Amount Tax Rate.

Total Amount Paid. Real Estate Transfer Tax Calculator. What is Transfer Tax.

You can also find the total amount paid by entering the revenue tax stamp paid. This calculation is based on 160 per thousand and the first 500 is exempt. Real Estate Transfer Declaration of.

Iowa Real Estate Tax tables. Monroe County Iowa - Real Estate Transfer Tax Calculator. Returns either Total Amount Paid or Amount Due.

Approximate Purchase Price Department Directory. You can also find the total amount paid by entering the revenue tax stamp paid. Calculate the real estate transfer tax by entering the total amount paid for the property.

Iowa charges a transfer tax of 016 with the first 500 property value being exempt from the states transfer tax. The tax is imposed on the total amount paid for the property. Do not type commas or dollar signs into number fields.

Share Bookmark Share. Calculate the real estate transfer tax by entering the total amount paid for the property. The Iowa DOT fee calculator is NOT compatible with Mobile Devices smart phones.

Iowa IA Transfer Tax.

Tds On Sale Of Immovable Property Section 194 Ia Form 26qb Tax Deducted At Source Sale Tax Deductions

Property Transfer Tax Bc 2021 Ptt Calculator Exemptions Cost To Buy

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Is Life Insurance Taxable Forbes Advisor

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Hoa Fee Calculator Setting A Fair Fee For Homeowners Hoam

2021 Capital Gains Tax Rates By State

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Transfer Tax Calculator 2022 For All 50 States

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Stock Yield Calculator In 2022 Slide Rule Math Stock Exchange

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Jackson County Iowa Real Estate Transfer Tax Calculator Jackson County Iowa

Sba Loan Calculator Estimate Payments Lendingtree

A Breakdown Of Transfer Tax In Real Estate Upnest

Epf Calculator Pension Calculator How Pf Is Calculated Online Retirement Calculator Calculator Pensions